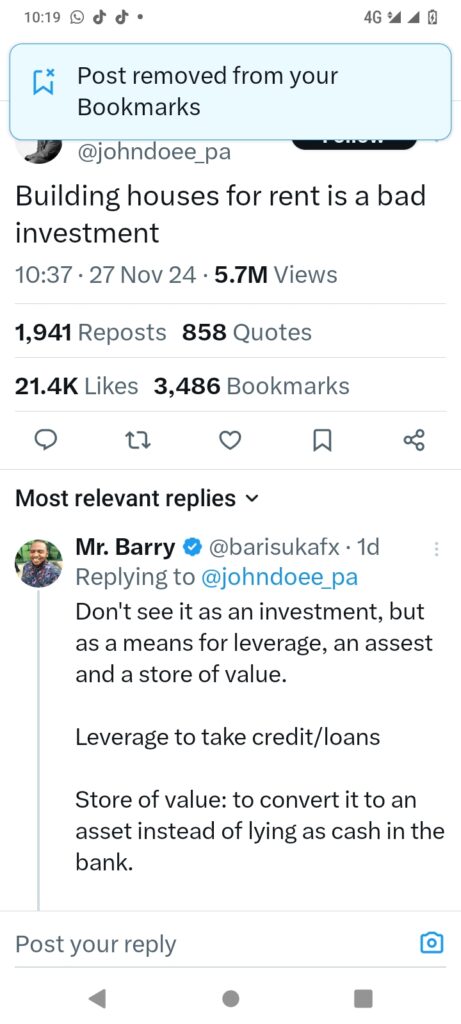

The real estate market in Lagos and across Nigeria has sparked a heated debate on whether building houses for rent is a good investment or a financial misstep. A recent tweet stating “Building houses for rent is a bad investment” has drawn diverse perspectives, with many agreeing, disagreeing, or offering a middle ground. We’ll explore the arguments for and against building houses for rent, using locations like Magodo and Lekki as case studies. We’ll also provide practical calculations to help investors make informed decisions.

Arguments Against Building Houses for Rent

- High Maintenance Costs: Rental properties often come with recurring maintenance costs, such as repairs, renovations, and tenant-related issues. In Lagos, landlords may also have to contend with utility management and the wear-and-tear of properties, which can erode profits.

- Regulatory and Tenancy Issues: Lagos State tenancy laws often favor tenants, making it difficult for landlords to evict defaulting tenants. The bureaucratic process involved can lead to financial losses and emotional stress.

- Low Rental Yields in Certain Areas: Rental income often does not match the capital outlay in prime areas like Lekki. For instance, a 4-bedroom duplex in Lekki Phase 1 might cost around ₦120 million to build, but the average annual rent is approximately ₦6 million. This results in a rental yield of about 5%, which may not outperform inflation or other investments.

Arguments For Building Houses for Rent

- Steady Cash Flow: Renting out properties provides a stable income stream. For example, in Magodo, a 3-bedroom flat rents for about ₦3.5 million annually. If you own multiple units, this cash flow can accumulate significantly over time.

- Asset Appreciation: Real estate in Lagos has a strong track record of appreciation. A property worth ₦100 million today could be valued at ₦150 million in five years, even if rental income is modest.

- Leverage and Store of Value: As highlighted in the tweet’s reply, real estate serves as collateral for loans and a hedge against inflation. Owning rental properties means converting cash into tangible assets, ensuring wealth preservation in Nigeria’s volatile economy.

Building to Sell: An Alternative Strategy

For investors skeptical about rental income, building to sell offers an attractive alternative. Here’s how the numbers stack up in Lekki:

- Construction Costs: Building a luxury 5-bedroom detached duplex in Lekki costs approximately ₦150 million.

- Selling Price: Such properties typically sell for around ₦250 million, yielding a profit of ₦100 million.

- Timeframe: Properties in high-demand areas like Lekki often sell within 6–12 months, offering quicker returns compared to rental income.

Practical Analysis: Magodo vs. Lekki

Case Study: Magodo Rental Property (amount are not reflective of present costs)

- Cost of Building: ₦80 million for a 3-bedroom flat.

- Annual Rent: ₦3.5 million.

- Rental Yield: ₦3.5 million ÷ ₦80 million = 4.375%.

- Payback Period: ₦80 million ÷ ₦3.5 million = 22.85 years.

Case Study: Lekki Rental Property

- Cost of Building: ₦120 million for a 4-bedroom duplex.

- Annual Rent: ₦6 million.

- Rental Yield: ₦6 million ÷ ₦120 million = 5%.

- Payback Period: ₦120 million ÷ ₦6 million = 20 years.

Case Study: Lekki Sale

- Cost of Building: ₦150 million for a luxury duplex.

- Selling Price: ₦250 million.

- Profit: ₦100 million.

- ROI: ₦100 million ÷ ₦150 million = 66.67%.

Balanced Recommendation

The decision to build for rent or sale depends on individual goals:

- For Long-Term Investors: Building for rent is ideal for those seeking steady cash flow and long-term asset appreciation. Areas like Magodo offer affordability and stable rental demand.

- For Quick Returns: Building to sell is more suitable for investors aiming to maximize short-term profits. Lekki remains a lucrative market for luxury properties.

- Leveraging Expertise: At Heritage Homes, we guide investors through the complexities of real estate, helping you choose strategies aligned with your financial objectives.

Conclusion

The debate on whether building houses for rent is a bad investment hinges on factors like location, investment goals, and risk appetite. While rental properties offer stability and asset growth, building to sell can deliver higher returns within shorter timeframes. For Nigerian investors navigating markets like Magodo and Lekki, it’s crucial to weigh the pros and cons carefully. Contact Heritage Homes today for expert advice on making the most of your real estate investments. Let us help you turn your property dreams into profitable realities.

Add a Comment